The Commercial Book-Entry System (CBES)

How CBES works

The commercial book-entry system (CBES) is a way for investors who work with banks, brokers, and dealers to get and pay for Treasury securities.

It works like this:

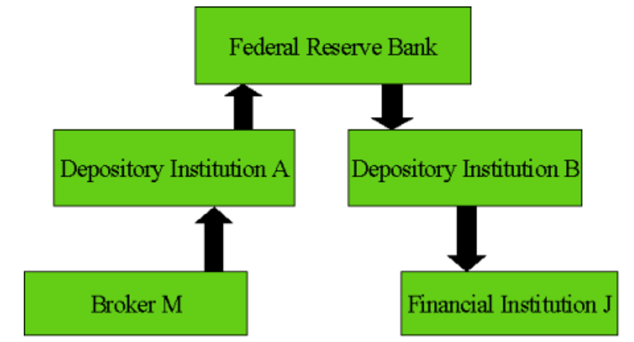

Example: A customer of Broker M is selling a security to a customer of Financial Institution J.

Here's what happens through CBES:

- Broker M delivers the securities to Depository Institution A by sending a message wire instructing Depository A's computer to deliver the securities to Financial Institution J.

- Depository A's computer sends the message to the Federal Reserve's book-entry computer, which debits Depository A for the security and credits Depository B's account for the security.

- Depository B's computer sends a message wire to Financial Institution J's computer to confirm electronic receipt of the security.

- Financial Institution J applies the security to the buyer's account.

- The money debits and credits follow a similar transaction path as the securities, but in reverse. The Federal Reserve Bank debits Depository B's reserve (money) account at the Fed and credits Depository Bank A's reserve account for the same amount.

Explaining each tier in CBES

As you can see, CBES is a multi-tiered automated system:

At the top tier, the Federal Reserve Banks run the National Book-Entry System.

The Federal Reserve Banks keep book-entry accounts for the U.S. Treasury, as well as for depository institutions, foreign central banks, and most government-sponsored enterprises.

At the next tier, depository institutions keep book-entry accounts for their customers.

Customers include brokers, dealers, institutional investors, and trusts.

At the bottom tier, each broker, dealer, and financial institution keeps book-entry accounts for individual customers, corporations, and other entities.

As you see, the transaction is between the brokers, dealers, or financial institutions. Neither Treasury nor the Federal Reserve Banks have records for individual owners of securities held in the commercial book-entry system. Disputes must be settled with the broker, dealer, or financial institution.

Individual customers with Treasury securities in the commercial book-entry system have no direct recourse against the U.S. Department of the Treasury or the Federal Reserve Bank.

As in any financial transaction, investors should exercise care in selecting a book-entry custodian or a broker-dealer.

Fees for CBES

Rules and regulations for CBES

Uniform Offering Circular

(The rules that set out the terms and conditions for the sale and issue of Treasury marketable securities)

31 CFR Part 356Buyback Rules

More InformationTRADES Regulations

(Information about the Treasury/Reserve Automated Debt Entry System, with a link to the regulations at 31 CFR Part 357, as well as information on how states and government-sponsored enterprises related to TRADES)

More Information