-

Home

This history of U.S. Savings Bonds is rich with images that tell the story of our nation’s heritage. Click the milestones below to explore the evolution of savings bonds from their infancy through the Digital Age.

-

1935

Birth of the U.S. Savings Bond

The U.S. Savings Bonds Program Begins

On February 1, 1935, President Franklin D. Roosevelt signed legislation that allowed the U.S. Department of the Treasury to sell a new type of security, the U.S. Savings Bond. One month later, the first Series A Savings Bond was issued. Its low purchase price of $18.75, with a face value of $25, eventually led the bond – along with the subsequent B (1936), C (1938) and D (1941) bond – to be nicknamed “the baby bond.”

Series A bond with a face value of $1,000 -

1941

World War II

The Launch of Defense Savings Bonds and Stamps

With the start of U.S. involvement in World War II in 1941, President Franklin D. Roosevelt announced the new Series E Defense Savings Bond – known informally as Defense Bonds – to finance the war on April 30. The next day, when it became available to the public, he purchased the first such bond from Treasury Secretary Henry Morgenthau. Following the attack on Pearl Harbor, Defense Bonds became known as War Savings Bonds, or informally as War Bonds. War Stamps were also introduced in small denominations (10¢, 25¢, 50¢, $1, $5) so any citizen could support the war for as little as one dime. The "Minute Man of Concord" sculpture, by David Chester French, was chosen as a symbol of the U.S. Savings Bonds Program.

Minute Man of Concord image on cover of War Victory Comics book

-

1942

World War II

Targeted Initiatives Help Finance the War

To help finance the war, the Treasury Department developed a number of initiatives targeting different audiences including American workers, women, and farmers. Additionally, the Treasury Department approved the use of a payroll deduction plan for the purchase of War Bonds. This later became known as the Payroll Savings Plan, and is still available electronically today.

War bonds poster aimed at women

-

1943

World War II

Nation Gets Behind War Bond Effort

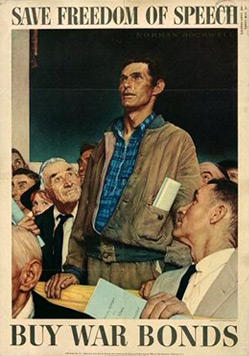

Artists, entertainers and schools pitched in to support the bond effort. Norman Rockwell's "Four Freedoms" paintings — originally published in The Saturday Evening Post — were taken on a nationwide department store tour, raising $130 million in War Bond sales. Occasionally, movie premieres offered admission with the purchase of a bond, while star-studded parades and touring shows entertained audiences and promoted bonds. The Hollywood Bond Cavalcade, for example, was a traveling variety show featuring the likes of Lucille Ball, Judy Garland and Mickey Rooney. Even schools got behind the bond effort, purchasing 90,000 Jeeps through bond and stamp purchases as part of the "Schools at War" program.

Norman Rockwell’s “Freedom of Speech” painting, part of the “Four Freedoms” series he created in support of the War Bond effort

-

1946

Cold War Era

Post-War Savings Bond Purchases

Savings bonds evolved into a popular way for families to build their nest egg. By 1945 and 1946, more Americans bought savings bonds than cashed them. Surveys at the time indicated many people resisted cashing their bonds to allow the savings to grow.

Series E Savings Bond featuring President Franklin D. Roosevelt -

1950

Cold War Era

Pop-Culture Influence on Bond Sales

To sustain post-war bond sales, the entertainment industry promoted U.S. Savings Bonds by integrating messages into television programs such as “Father Knows Best,” “Superman” and “Lassie.”

“Father Knows Best” character Betty “Princess” Anderson, played by Elinor Donahue, makes a promise to her father that she'll help sell savings bonds

-

1952

Cold War Era

H Bonds Issued

H Bonds offered a current income bond that paid interest every six months — and earned interest for 30 years. They were replaced by Series HH Savings Bonds in January 1980.

H bonds earned interest for 30 years -

1963

Cold War Era

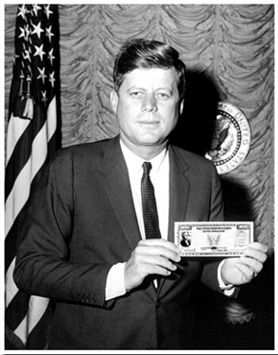

President Kennedy Helps Promote U.S. Savings Bonds

President John F. Kennedy encouraged Americans to purchase U.S. Savings Bonds. His administration established the U.S. Industrial Payroll Savings Committee, an organization of top business leaders aimed at spearheading payroll savings campaigns in American industry. Its first campaign, staged in 1963, stimulated the largest enrollment of new payroll savers since World War II. President Kennedy met and thanked the Committee in the Rose Garden of the White House on November 5, 1963 – just 17 days before his assassination.

President John F. Kennedy holds a U.S. Savings Bond -

1966

Cold War Era

Celebrating the Savings Bond Tradition Through Film

The 25th anniversary of the Series E Savings Bond in 1966 saluted the broadcasting industry for the millions of promotional words (and musical notes) it had contributed to bond sales since 1941. The Treasury Department, in collaboration with the motion picture industry, produced a short film titled “The Land We Love” that tied the nation's history and geography to the savings bond tradition. A second film, the “Star Spangled Salesman,” was produced two years later and featured stars such as Carol Burnett, Milton Berle, Howard Morris and The Three Stooges.

Photo from the set of “Star Spangled Salesman,” starring actors Milton Berle and Howard Morris

-

1976

Cold War Era

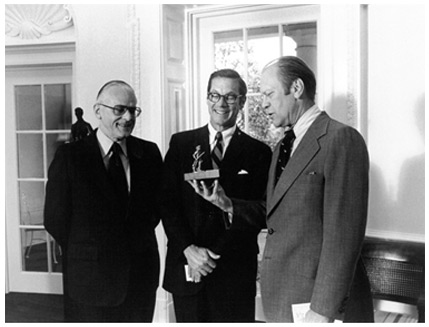

America's Bicentennial and the 35th Anniversary of the U.S. Savings Bonds Program

President Ford was a strong supporter of the U.S. Savings Bonds Program. During his presidency, the nation's 200th birthday coincided with the 35th anniversary of the U.S. Savings Bonds Program. The film "An American Partnership" celebrated the Bicentennial and highlighted a yearlong campaign honoring the role of citizens in financing the nation's growth.

President Gerald Ford with a miniature “Minute Man of Concord” statue – symbol of the U.S. Savings Bonds Program

-

1980

Cold War Era

U.S. Savings Bonds Hit the Speedway

The 1980s continued to promote savings bonds through pop culture references. The decade started with the introduction of Series EE and HH Bonds. Later, “Cheers” television show characters made witty references to savings bonds, and famed race car driver Aloysius (Cappy) Coleman Jr. took the wheel of the official U.S. Savings Bonds race car. The car made its debut in 1989 at the Charlotte Motor Speedway in North Carolina.

HH bond featuring George Washington

-

1990

Cold War Era

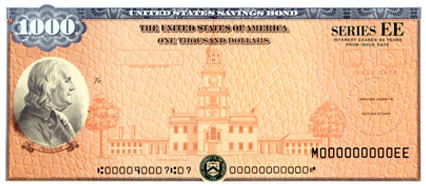

Introduction of the Education Savings Bond Program

To help Americans finance their dream of a college education, Congress created the Education Savings Bond program. Under this program, Series EE Savings Bonds purchased by qualified taxpayers on or after January 1, 1990, are tax-free if used to pay tuition and fees at eligible educational institutions.

$1,000 Series EE Savings Bond featuring Benjamin Franklin

-

1991

Globalization and the Digital Age

The Golden Anniversary of Series E Savings Bonds

Fifty years after the introduction of the Series E Savings Bond, the Treasury Department launched a yearlong golden anniversary campaign, “Celebrate an American Tradition – 50 Years of U.S. Savings Bonds.” The campaign included public service announcements featuring Bugs Bunny as well as a publication of the history of the U.S. Savings Bond Program.

“Bugs Bunny 50th” public service announcement

-

1998

Globalization and the Digital Age

The Birth of The Series I Savings Bond

The Treasury Department introduced the Series I Savings Bond to encourage more Americans to save for the future while protecting their savings against inflation. The new bond series, launched at an official ceremony led by Vice President Al Gore, is indexed to the Consumer Price Index in denominations as small as $50. Artwork on the bonds feature eight historical figures from the late 19th and 20th centuries, including: Helen Keller, Dr. Martin Luther King Jr., Dr. Hector P. Garcia, Chief Joseph, Gen. George C. Marshall, Albert Einstein, Marian Anderson and Spark M. Matsunaga.

Series I Savings Bonds feature images of honored and distinguished Americans, such as Helen Keller and Dr. Martin Luther King, Jr.

-

2002

Globalization and the Digital Age

Savings Bond Purchases Available Electronically

The U.S. Department of the Treasury's Bureau of the Public Debt first made digital Series I Savings Bonds available for purchase online in 2002. The digital Series EE Savings Bond soon followed. The TreasuryDirect.gov website was launched in 2004, offering Americans a one-stop shop for purchasing and redeeming savings bonds and other Treasury securities online.

TreasuryDirect.gov when first launched in 2004 -

2012

Globalization and the Digital Age

An Online Savings Bond Program

As of January 1, 2012, paper savings bonds are no longer being sold over the counter at banks and other financial institutions. Instead, Americans can continue to buy savings bonds online from the convenience of home through TreasuryDirect.gov. Opening a TreasuryDirect account is free, and you can buy and manage your savings bonds online, anytime – 24 hours a day, 7 days a week. You can also purchase online savings bonds as gifts – TreasuryDirect offers a variety of gift certificates for any occasion. Visit TreasuryDirect.gov for more information.

TreasuryDirect gift certificate